Getting My International Debt Collection To Work

Getting The Debt Collection Agency To Work

Table of ContentsThe International Debt Collection DiariesThe Basic Principles Of Business Debt Collection A Biased View of International Debt CollectionLittle Known Facts About Private Schools Debt Collection.What Does Personal Debt Collection Do?

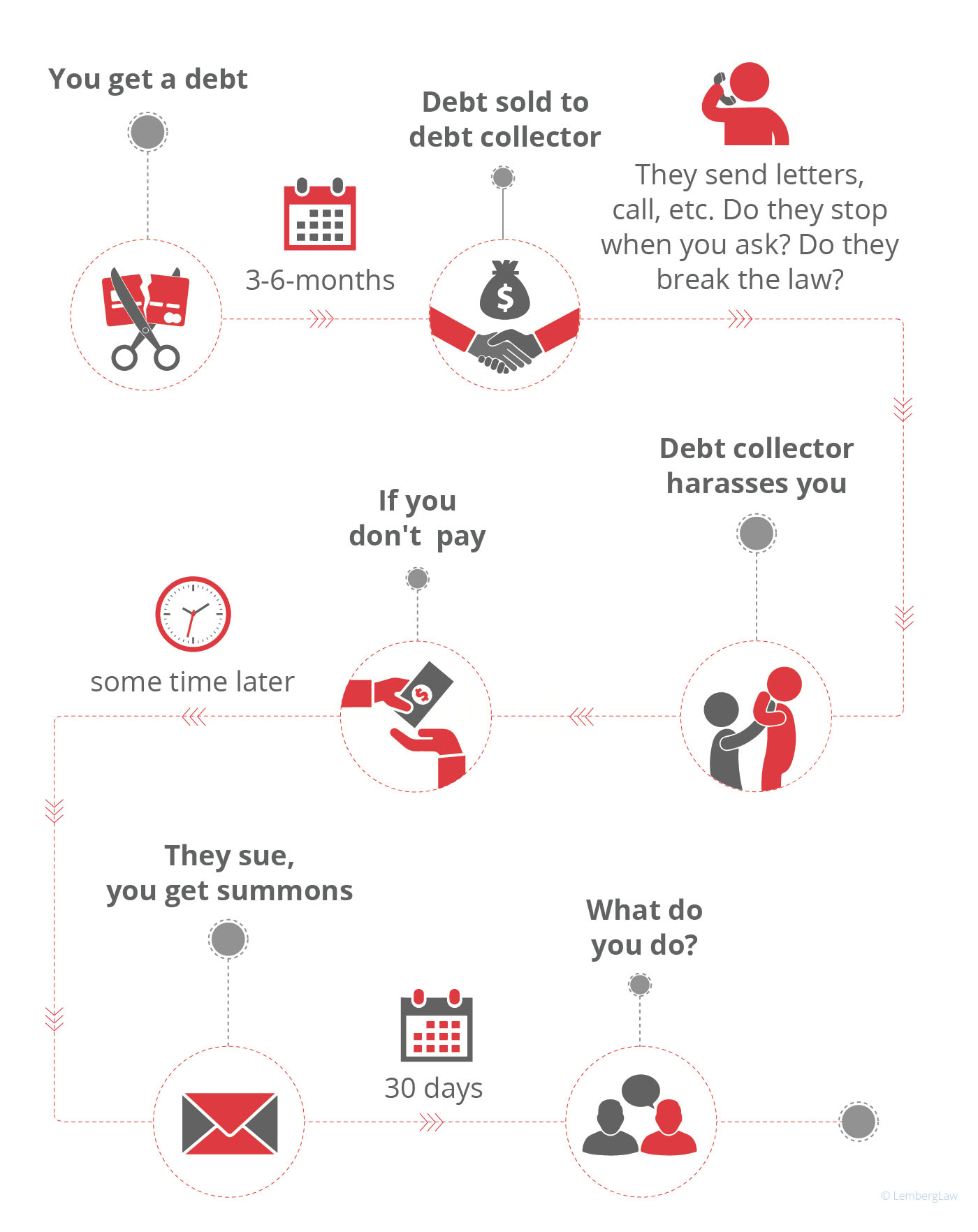

You can ask a collection agency to quit contacting you and also dispute the financial obligation if you assume it's incorrect.: agree to a settlement strategy, clean it out with a single repayment or discuss a negotiation.The enthusiast can not inform these individuals that you owe money. The collection company can call an additional individual just as soon as.

It can, but does not have to accept a deposit strategy (Business Debt Collection). An enthusiast can ask that you compose a post-dated check, however you can not be needed to do so. If you provide a debt collector a post-dated check, under federal legislation the check can not be transferred prior to the day written on it

The best financial obligation collector work descriptions are concise yet engaging. Once you have a solid initial draft, review it with the hiring manager to make certain all the information is precise and also the requirements are strictly essential.

How Dental Debt Collection can Save You Time, Stress, and Money.

The Fair Debt Collection Practices Act (FDCPA) is a government legislation imposed by the Federal Profession Payment that shields the civil liberties of customers by banning particular techniques of financial obligation collection. The FDCPA puts on the practices of financial obligation collectors and also attorneys. It does not put on financial institutions who are trying to recoup their own debts.

The FDCPA does not use to all financial obligations. It does not use to the collection of company or company debts.

It is not meant to be lawful advice regarding your certain problem or to alternative to the advice of an attorney.

The Main Principles Of Business Debt Collection

Personal, family and house debts are covered under the Federal Fair Debt Collection Act. This includes cash owed for treatment, charge accounts or vehicle acquisitions. Business Debt Collection. A debt collection hop over to these guys agency is anyone other than the financial institution who regularly gathers or tries to collect debts that are owed to others as well as that arised from customer transactions

Once a financial debt enthusiast has informed you by phone, she or he must, within five days, send you a written notice disclosing the quantity you owe, the name of the lender to whom you owe cash, and what to do if you challenge the financial debt. A debt collection agency might NOT: bother, oppress or abuse anyone (i.

You can stop a financial obligation collection agency from contacting you by creating a letter to the debt collection agency informing him or her to stop. When the agency obtains your letter, it may not call you once again other than to inform you that some particular activity will be taken. A debt collector may not call you if, within one month after the collector's first get in touch with, you send the collector a letter specifying that you do not owe the cash.

:max_bytes(150000):strip_icc()/debt-validation-requires-collectors-to-prove-debts-exist-960594-V1-a13dc2e2066f49c38ebc05f515de9492.jpg)

Some Of Business Debt Collection

This material is readily available in alternate style upon request.

Instead, the lending institution might either employ a firm that is hired to gather third-party debts or sell the financial obligation to a debt collector. When the financial obligation has actually been marketed to a financial obligation debt collection agency, you might begin to get telephone calls and/or letters from that company. The debt collection sector is heavily managed, and also customers have several legal rights when it comes to managing costs enthusiasts.

Regardless of this, financial obligation enthusiasts will attempt whatever in their power to obtain you to pay your old financial obligation. A financial obligation enthusiast can be either a private person or a firm.

Financial debt debt collector are hired by lenders and also are generally paid a percentage of the amount of the financial obligation they recoup for the financial institution. The percentage a debt collection agency fees is typically based on the age view it of the financial debt and also the quantity of the debt. Older financial debts or higher financial debts might take even more time to gather, so a collection firm might bill a greater percentage for collecting those.

Debt Collection Agency Things To Know Before You Buy

Others deal with a contingency basis and just charge the financial institution if they succeed in gathering on the financial obligation. The financial obligation debt see this here collection agency becomes part of an arrangement with the lender to accumulate a portion of the debt the percentage is stipulated by the financial institution. One financial institution could not agree to resolve for less than the sum total owed, while an additional may accept a settlement for 50% of the financial debt.